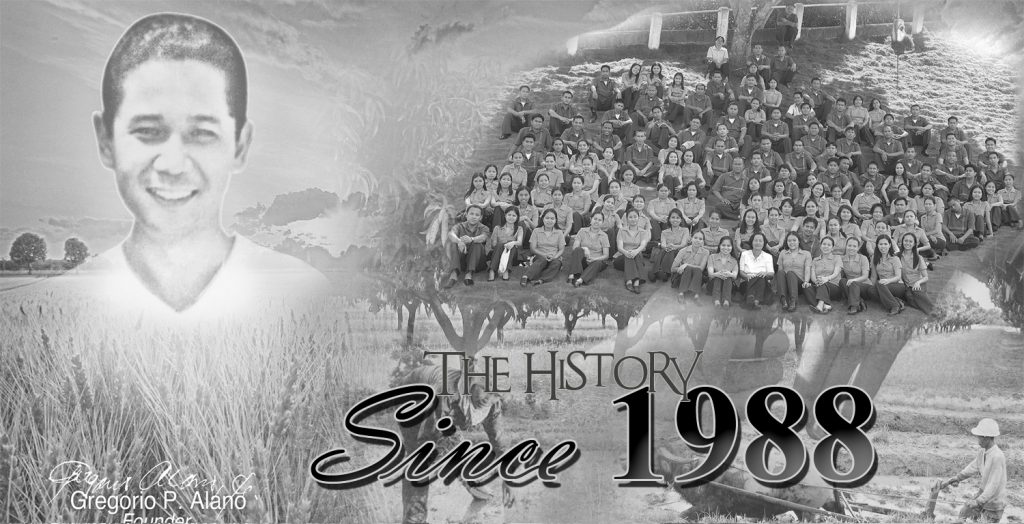

Alano & Sons Credit Corporation was founded on August 8, 1988, but was still officially known as GA Lending Investors. This business name was derived from the initials of its brilliant founder, GREGORIO ALANO, JR., the late husband of the company’s present president and from whose initials the existing company logo was based. The company started on very humble beginnings with only four employees manning the operations in its small former office at the Roxy Building, Dipolog City, but this sparse and meager start was backed up with the brilliant ideas and magnanimous intentions of the founder to improve his young family’s lot and to help other families who are in the same situation better theirs.

The company experienced birthing and growing pains just like any other company, but was poised for flight with the able leadership of its founder. The company was, however, put to its first major test when its founder died on October 9, 1996. Bearing the blow of this major setback, the founder’s widow, Mrs. Bienvenida T. Alano, took up the cudgels and moved on to continue what her husband had started. Equipped with her husband’s brilliant ideas and concern for people’s lives, and coupled with her acute business acumen and strong determination to continue her husband’s legacy, Mrs. Alano reigned in the ropes and started managing the young company.

Her perseverance and unique touch in managing the company initially paid off when in November 1999, the Company moved to its own building located at Malvar Street, Dipolog City. This triumph was shortly followed on August 20, 2001, when another edifice owned by the Alano Family along Quezon Avenue was blessed and formally opened to house the company’s expanding operations. During this time, Mrs. Alano added another woman’s touch to the company when she appointed Ma. Diadema Arocha as the Chief Executive Officer (CEO) of the company.

During this time, the main office located at the newly opened building along Quezon Avenue concentrated on providing financial services to teachers while the Microfinance Office at Malvar Street offered daily loan program to small -scale businessmen.

At the start, the bulk of GA’s clients were teachers and other government employees with the founder and present president being former teachers themselves, until it expanded its services to people from all walks of life.

Emboldened by the strides the company has made, the president and the personnel became more aggressive in handling the business and opened more offices during the year 2002.

On October 3, 2003, the business name, GA Lending Investors, was officially changed to Alano & Sons Finance Corporation in compliance with the requirement of the Security and Exchange Commission.

The successes of the branch openings in Zamboanga del Norte and Misamis areas further opened the eyes of the company to become more aggressive in pursuing business expansions in unfamiliar turfs and highly competitive markets particularly in Cebu.

In 2004 the company further stretched its wings and opened branches in Cebu and Mandaue branches. The growth spurt of the company continued in the next two years leading to the opening of more branches in Cebu province, Misamis Occidental and Zamboanga Peninsula Areas.

The company also finally earned its present name, Alano & Sons Credit Corporation (ASCC), during this year taking its full effect on September 1, 2006.

ASCC further extended its operations in Zamboanga Peninsula, Zamboanga del Sur, Negros and Siquijor areas.

Despite the wide reach and range the company has had in just a short span of time, all the operating branches remain steadfast in the company’s basic policies, work ethic, and guiding principles, and remain under the watchful eyes and caring hands of its president who has made the company what it is now.

And still imbued with the brilliant spirit of its founder whose earnest desire was to primarily help individuals and families achieve financial mobility and capability, the Company is still planning to expand its empire across the Mindanao and Visayas regions to be able to provide more individuals and more families this financial strength.